WHY IS ASSET ALLOCATION IMPORTANT:

A portfolio's long-term performance is determined primarily by the distribution of dollars among asset classes, such as stocks, bonds and cash equivalents.The asset allocation decision is one of the most important decisions you will make as an investor. You may think that security selection and market timing are the primary components driving a portfolio's performance, but these factors are only important when combined with a strategic asset allocation policy.Recent studies found that a portfolio's asset allocation policy dominates portfolio performance and, over a period of time, typically explains 90% of the variation in the portfolio's returns. This far exceeds the effects of both market timing and security selection, demonstrating that the asset allocation decision is the most important determinant of portfolio performance.Source: Brinson, Gary P. et al. "Determinants of portfolio performance", Financial Analysts Journal, July/August 1986. Updated in Financial Analysts Journal, May/June 1991.

WHY YOU SHOULD REBALANCE YOUR PORTFOLIO:

Reducing Portfolio Risk Through RebalancingResearch has shown that periodic rebalancing of investment portfolios may help reduce market risk over time. This may be especially true during volatile periods when overexposure to some asset classes due to policy drift can cause wide swings in risk exposure.3 Today, investors are well aware of the potential upsides and downsides of not rebalancing. A buy-and-hold approach works well when markets move in a single direction, but poorly when markets swing wildly in many directions. While it may seem counterintuitive to rebalance a portfolio during an up market, it is now apparent why investors would be wise to do so. Market volatility can increase and decrease much faster than it takes for an investment committee to set a meeting and draft new policy, leaving portfolios vulnerable to fits of volatility and widely inconsistent returns.Source: Ibbotson Associates, Inc.Rebalancing for the Long-termMarkets have a history of turning quickly and overreacting to short-term news. Institutional investors, however, should be more concerned with meeting long-term investment objectives than daily market fluctuations, especially during volatile periods. While it may seem counterintuitive to “give up” some returns by rebalancing a portfolio when markets are moving in a single direction, the long-term investor who does rebalance will be potentially better suited for volatile times, particularly when asset classes move in opposite directions.Source: State Street Global Advisors

WHY MARKET TIMING DOES NOT WORK:

Investors who attempt to time the market run the risk of missing periods of exceptional returns. This practice may have a negative effect on a sound investment strategy.This image illustrates the risk of attempting to time the stock market over the past 20 years.A hypothetical $1 investment in stocks invested at year-end 1985 grew to $9.52 by year-end 2005. However, that same $1 investment would have only grown to $2.34 had it missed the 17 best months of stock returns. One dollar invested in Treasury bills over the 20-year period resulted in an ending wealth of $2.46. An unsuccessful market timer, missing the 15 best months of stock returns, would have received a return just above that of Treasury bills.Although successful market timing may improve portfolio performance, it is very difficult to time the market consistently. In addition, unsuccessful market timing can lead to significant opportunity loss.

Source: Ibbotson Associates, Inc. 2006.

WHAT IS A LADDERED BOND PORTFOLIO:

Just like stock investing, diversification is equally important in bond investing. Bond laddering is a practice whereby bonds' interest rate risk is spread over a series of different maturities, while maintaining an average maturity of your liking in your portfolio. This particular risk means that any fluctuation in interest rate will inversely affect the bonds' price, and eventually the yield. The rationale behind laddering isn't complicated. When you buy bonds with short-term maturities, you have a high degree of stability. However, because these bonds are not very sensitive to changing interest rates, you have to accept a lower yield. When you buy bonds with long-term maturities, you can receive a higher yield, but you must also accept the risk that the prices of the bonds might change. With a laddered portfolio, you would realize greater returns than from holding only short-term bonds, but with lower risk than holding only long-term bonds. By spreading out the maturities of your portfolio, you get protection from interest rate changes.The advantage is that you don't need to worry about interest rates - especially if the ladder you construct has notes coming due every couple of years or so. If rates do rise soon after you bought this year's bonds, you can take comfort in the fact that soon you will have money coming available to take advantage of the change. Similarly, if rates decline after you buy, you've managed to lock in the higher rates for that portion of your portfolio. The bottom line is, you won't get stuck one way or the other.Key Benefits of CCMA Fixed Income Portfolios- Laddering maturities can protects against interest rate risks associated with rising and falling interest rate markets.- Can be designed to provide additional liquidity as needed by over-weighting maturities in the future when those funds are needed.- Can provide predictable income with lower fluctuation of principal than equities.- Government Bonds, when held to maturity, return face value of the Bond or Note.- Corporate Debt is less secure due to the credit worthiness of the underlying guarantor - it is important to evaluate your risk profile for investments in other than "investment grade" debt.

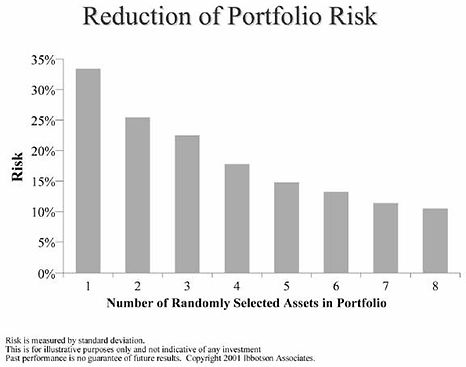

WHY IS DIVERSIFICATION IMPORTANT:

As the number of asset classes in portfolio increases, the total risk or volatility of the portfolio decreases.Diversification is the strategy of holding more than one asset class in a portfolio in order to reduce risk. This image depicts the relationship between portfolio volatility, measured by standard deviation, and the number of asset classes included in a portfolio.You can limit the effect any individual security or asset class may have on the performance of your portfolio by investing in a combination of asset classes. As a result, declines in one or two assets may be offset by increases in others. Notice that as the number of randomly selected assets in the portfolio increases, the risk level decreases.While it is impossible to completely avoid risk, diversifying your investments can reduce the overall volatility your portfolio experiences.Source: Ibbotson Associates, Inc. 2001